Market Outlook

November 22, 2017

Market Cues

Domestic Indices

Chg (%)

(Pts)

(Close)

Indian markets are likely to open flat tracking global indices and SGX Nifty.

BSE Sensex

0.4

118

33,478

Nifty

0.3

28

10,327

U.S. stocks rose to record highs on Tuesday as a rally in tech lifted the broader

market. Investors also cheered strong quarterly results from top companies in

Mid Cap

0.1

16

16,794

Corporate America.

Small Cap

0.4

66

17,813

Bankex

(0.0)

(14)

29,207

The European markets ended Tuesday's session in the green, adding to the modest

gains of the previous session. Traders remain in a cautious mood due to the political

Global Indices

Chg (%)

(Pts)

(Close)

uncertainty in Germany. However, the markets received a boost from some positive

corporate news. The early gains on Wall Street also provided support in the

Dow Jones

0.7

161

23,430

afternoon

Nasdaq

1.1

72

6,862

FTSE

0.3

22

7,411

Indian markets closed higher of the fourth consecutive session on Tuesday, although

Nikkei

0.7

155

22,416

overall gains remained muted ahead of derivatives expiry due next week.

Hang Seng

1.9

558

29,818

News Analysis

Shanghai Com

0.5

18

3,410

Dr Reddy's (DRL) gets EIR for Vizag Plant

Detailed analysis on Pg2

Advances / Declines

BSE

NSE

Advances

1,460

1,103

Investor’s Ready Reckoner

Declines

1,258

650

Key Domestic & Global Indicators

Unchanged

160

74

Stock Watch: Latest investment recommendations on 150+ stocks

Refer Pg5 onwards

Volumes (` Cr)

Top Picks

BSE

3,572

CMP

Target

Upside

Company

Sector

Rating

NSE

33,643

(`)

(`)

(%)

Blue Star

Capital Goods

Buy

697

867

24.4

Dewan Housing Finance

Financials

Accumulate

621

712

14.6

Net Inflows (` Cr)

Net

Mtd

Ytd

Asian Granito

Other

Buy

494

570

15.4

FII

289

14,403

52,855

Navkar Corporation

Other

Buy

190

265

39.2

MFs

2,326

3,825

99,236

KEI Industries

Capital Goods Accumulate

333

380

14.2

More Top Picks on Pg4

Top Gainers

Price (`)

Chg (%)

Key Upcoming Events

Rcom

13

11.6

Previous

Consensus

Date

Region

Event Description

Reading

Expectations

Mcleodruss

192

11.5

Nov22

US

Initial Jobless claims

249.00

240.00

Trent

337

7.4

Nov22

Germany GDP nsa (YoY)

2.30

2.30

Sadbhav

340

7.3

Nov23

Euro Zone Euro-Zone Consumer Confidence

(1.00)

(0.80)

Gppl

140

5.9

Nov23

Germany PMI Services

54.70

55.00

Nov23

US

New home sales

667.00

615.00

More Events on Pg7

Top Losers

Price (`)

Chg (%)

Jetairways

663

(8.0)

Renuka

17

(6.4)

Gati

133

(5.8)

L&Tfh

179

(4.8)

Adanient

153

(4.3)

As on November, 21 2017

Market Outlook

November 22, 2017

News Analysis

Dr Reddy's (DRL) gets EIR for Vizag Plant

Dr Reddy's Laboratories (DRL) today received an establishment inspection report

(EIR) from the US health regulator for its formulation manufacturing facility at

Duvvada in Visakhapatnam. However, it said that the US Food and Drug

Administration has not closed the inspection & the manufacturing site's status

remains unchanged. In the cover letter the USFDA, has explained that inspection

has not closed & the site's status remains unchanged.

The USFDA has released the EIR in order to be transparent about its regulatory

process. DRL plans to request a re-inspection in 2018 after further discussion on

scheduling with the US regulator for its Duvvada facility. As far financials are

concerned, the event won’t change the status of the company as EIR is just an

observation note and doesn’t equates to the company getting a clean chit from

USFDA.

EIR is the name given by the US Food and Drug Administration (US FDA) for an

entire narration of what the FDA investigator / inspector did during the time spent

at the establishment (facility), from the stage of introductions till the handover of

the inspectional observations (termed as Form FDA 483). The EIR is expected to be

a compilation of factual information. Thus we maintain reduce recommendation

with a Price Target of `2,040.

Eris Lifesciences - Book profit

Ahmadabad based Pharma Company Eris Lifesciences had came with an IPO in

June 2017. The issue was oversubscribed by 3.3x. Eris Life is a specialty pharma

company with 100% focus on the domestic market. It owns and operates a

manufacturing facility in Guwahati, Assam. Company also outsources

manufacturing of its certain products. The company has reported impressive

record of growth and profitability. Considering the track record, we had put a

subscribe rating on the issue. The stock at the CMP of `648 yields about 7%

returns from the IPO price and we believe that investors should book profit in the

scrip.

Economic and Political News

Railways will now use big data and AI to make your train travel safer

ICRA sees GVA growth inching up to 6.3% in Q2

India's food processing sector may attract $33 bn by 2024: Assocham survey

Corporate News

Future Group aims to open 10,000 Easyday stores by 2022

Muthoot Capital raises `165 cr via QIP, dilutes 12.5% stake

Dabur passes on benefits of GST rate cut, reduces some product prices by

9%

Market Outlook

November 22, 2017

Top Picks HHHHH

Market Cap

CMP

Target

Upside

Company

Rationale

(` Cr)

(`)

(`)

(%)

Strong growth in domestic business due to its leade`hip

in acute therapeutic segment. Alkem expects to launch

Alkem Laboratories

23,368

1,954

2,125

8.7

more products in USA, which bodes for its international

business.

We expect the company would report strong profitability

Asian Granito

1,486

494

570

15.4

owing to better product mix, higher B2C sales and

amalgamation synergy.

Favorable outlook for the AC industry to augur well for

Cooling products business which is out pacing the

Blue Star

6,681

697

867

24.4

market growth. EMPPAC division's profitability to

improve once operating environment turns around.

With a focus on the low and medium income (LMI)

consumer segment, the company has increased its

Dewan Housing Finance

19,486

621

712

14.6

presence in tier-II & III cities where the growth

opportunity is immense.

Loan growth is likely to pick up after a sluggish FY17.

Lower credit cost will help in strong bottom-line growth.

Karur Vysya Bank

7,348

122

180

48.0

Increasing share of CASA will help in NIM

improvement.

High order book execution in EPC segment, rising B2C

KEI Industries

2,608

333

380

14.2

sales and higher exports to boost the revenues and

profitability

Expected to benefit from the lower capex requirement

Music Broadcast

2,116

371

434

17.0

and 15 year long radio broadcast licensing.

Massive capacity expansion along with rail advantage

Navkar Corporation

2,866

190

265

39.2

at ICD as well CFS augur well for the company

Strong brands and distribution network would boost

Siyaram Silk Mills

2,741

585

650

11.1

growth going ahead. Stock currently trades at an

inexpensive valuation.

Market leadership in Hindi news genre and no.

2

viewership ranking in English news genre, exit from the

TV Today Network

2,247

377

435

15.5

radio business, and anticipated growth in ad spends by

corporate to benefit the stock.

After GST, the company is expected to see higher

volumes along with improving product mix. The Gujarat

Maruti Suzuki

2,54,457

8,424

8,890

5.5

plant will also enable higher operating leverage which

will be margin accretive.

We expect loan book to grow at 24.3% over next two

GIC Housing

2,323

431

655

51.8

year; change in borrowing mix will help in NIM

improvement..

Source: Company, Angel Research

Market Outlook

November 22, 2017

Key Upcoming Events

Global economic events release calendar

Bloomberg Data

Date

Time Country

Event Description

Unit

Period

Last Reported

Estimated

Nov 22, 2017

7:00 PMUS

Initial Jobless claims

Thousands

Nov 18

249.00

240.00

12:30 PMGermany

GDP nsa (YoY)

% Change

3Q F

2.30

2.30

Nov 23, 2017

8:30 PMEuro Zone

Euro-Zone Consumer Confidence

Value

Nov A

(1.00)

(0.80)

2:00 PMGermany

PMI Services

Value

Nov P

54.70

55.00

8:30 PMUS

New home sales

Thousands

Oct

667.00

615.00

2:00 PMGermany

PMI Manufacturing

Value

Nov P

60.60

60.40

Nov 27, 2017

3:00 PMUK

GDP (YoY)

% Change

3Q P

1.50

1.50

Nov 28, 2017

8:30 PMUS

Consumer Confidence

S.A./ 1985=100

Nov

125.90

123.75

Nov 29, 2017

7:00 PMUS

GDP Qoq (Annualised)

% Change

3Q S

3.00

3.30

Nov 30, 2017

2:25 PMGermany

Unemployment change (000's)

Thousands

Nov

(11.00)

6:30 AMChina

PMI Manufacturing

Value

Nov

51.60

Dec 01, 2017

3:00 PMUK

PMI Manufacturing

Value

Nov

56.30

Dec 05, 2017

3:30 PMEuro Zone

Euro-Zone GDP s.a. (QoQ)

% Change

3Q F

0.60

Dec 06, 2017

2:30 PMIndia

RBI Reverse Repo rate

%

Dec 6

5.75

2:30 PMIndia

RBI Repo rate

%

Dec 6

6.00

2:30 PMIndia

RBI Cash Reserve ratio

%

Dec 6

4.00

Dec 08, 2017

India

Imports YoY%

% Change

Nov

7.60

3:00 PMUK

Industrial Production (YoY)

% Change

Oct

2.50

India

Exports YoY%

% Change

Nov

(1.10)

China

Exports YoY%

% Change

Nov

6.90

7:00 PMUS

Change in Nonfarm payrolls

Thousands

Nov

261.00

7:00 PMUS

Unnemployment rate

%

Nov

4.10

Dec 09, 2017

7:00 AMChina

Consumer Price Index (YoY)

% Change

Nov

1.90

Dec 12, 2017

5:30 PMIndia

Industrial Production YoY

% Change

Oct

3.80

Source: Bloomberg, Angel Research

Market Outlook

November 22, 2017

Macro watch

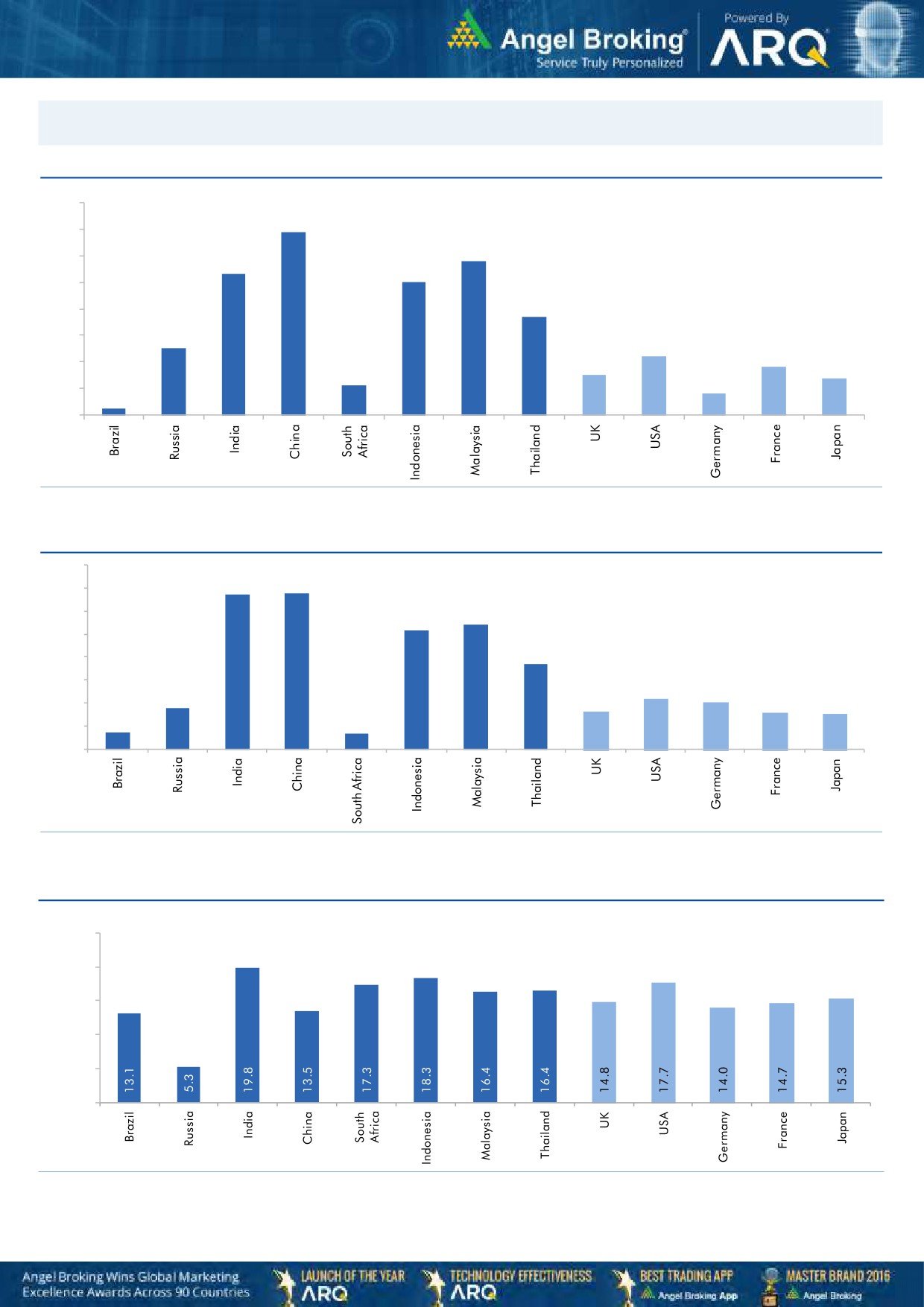

Exhibit 1: Quarterly GDP trends

Exhibit 2: IIP trends

(%)

(%)

10.0

6.0

9.1

5.1

8.8

9.0

5.0

4.4

4.5

8.0

7.9

7.6

7.5

3.8

8.0

7.3

7.2

4.0

3.5

7.0

3.2

2.9

7.0

6.1

6.1

3.0

2.4

5.7

6.0

2.0

1.2

5.0

0.9

1.0

4.0

-

3.0

(1.0)

(0.3)

Source: CSO, Angel Research

Source: MOSPI, Angel Research

Exhibit 3: Monthly CPI inflation trends

Exhibit 4: Manufacturing and services PMI

56.0

Mfg. PMI

Services PMI

(%)

4.5

54.0

3.9

4.0

3.6

3.7

3.6

52.0

3.4

3.2

3.3

3.3

3.5

3.0

50.0

3.0

2.4

48.0

2.5

2.2

2.0

46.0

1.5

1.5

44.0

1.0

42.0

0.5

40.0

-

Source: Market, Angel Research; Note: Level above 50 indicates expansion

Source: MOSPI, Angel Research

Exhibit 5: Exports and imports growth trends

Exhibit 6: Key policy rates

(%)

Exports yoy growth

Imports yoy growth

(%)

Repo rate

Reverse Repo rate

CRR

60.0

6.50

50.0

6.00

40.0

5.50

30.0

5.00

20.0

4.50

10.0

4.00

0.0

3.50

(10.0)

3.00

Source: Bloomberg, Angel Research

Source: RBI, Angel Research

Market Outlook

November 22, 2017

Global watch

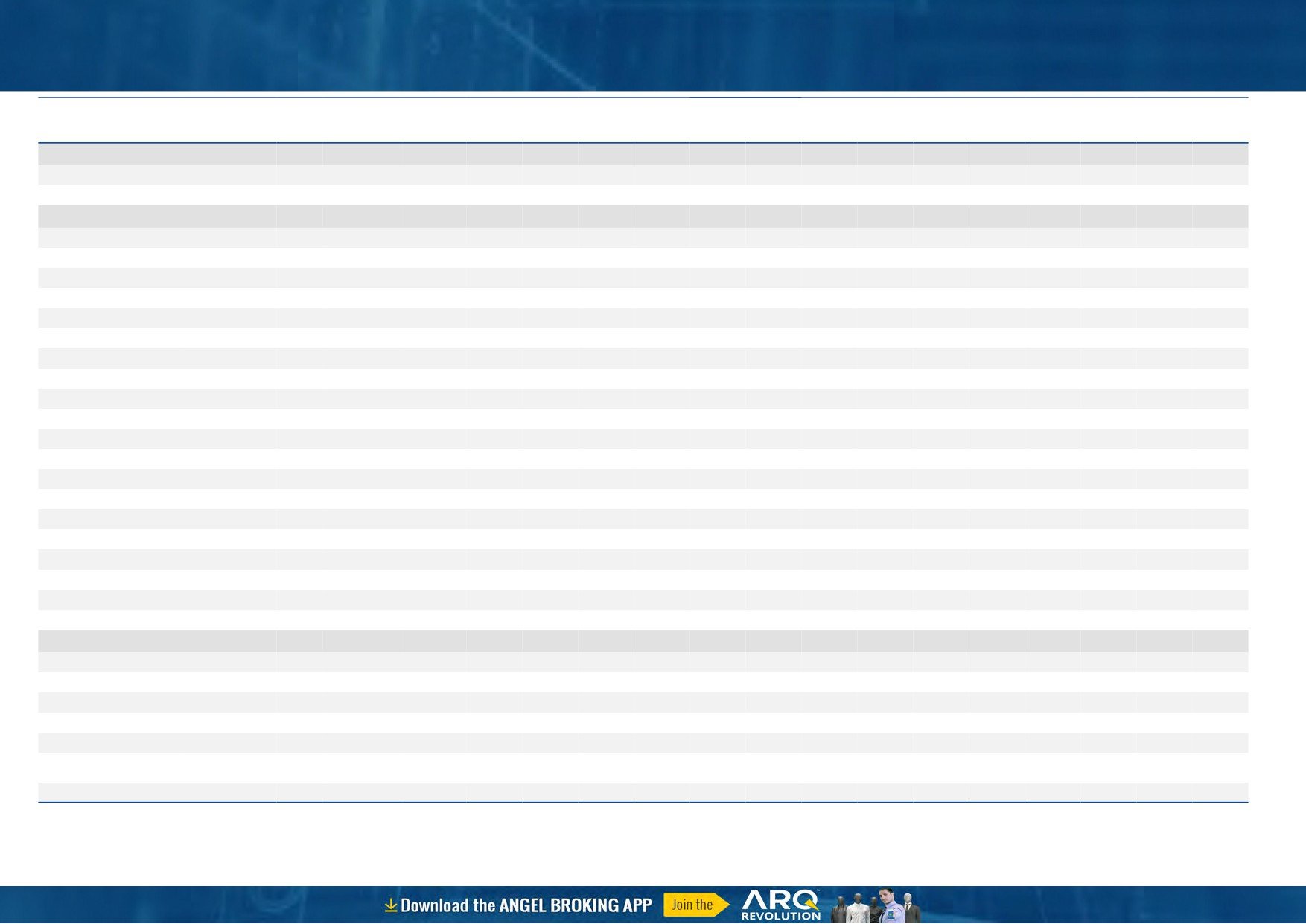

Exhibit 1: Latest quarterly GDP Growth (%, yoy) across select developing and developed countries

(%)

8.0

6.9

7.0

5.8

6.0

5.3

5.0

5.0

1.1

3.7

4.0

2.5

3.0

2.2

1.8

2.0

1.5

1.4

0.8

1.0

0.3

-

Source: Bloomberg, Angel Research

Exhibit 2: 2017 GDP Growth projection by IMF (%, yoy) across select developing and developed countries

(%)

6.7

6.8

7.0

6.0

5.4

5.2

5.0

3.7

4.0

3.0

1.8

2.2

2.0

1.7

1.6

2.0

0.7

1.5

0.7

1.0

-

Source: IMF, Angel Research

Exhibit 3: One year forward P-E ratio across select developing and developed countries

(x)

25.0

20.0

15.0

10.0

5.0

-

Source: IMF, Angel Research

Stock Watch

November 22, 2017

Company Name

Reco

CMP

Target

Mkt Cap

Sales ( Čcr )

OPM(%)

EPS (Č)

PER(x)

P/BV(x)

RoE(%)

EV/Sales(x)

(Č)

Price ( Č)

( Č cr )

FY18E FY19E

FY18E

FY19E

FY18E

FY19E

FY18E

FY19E

FY18E

FY19E

FY18E

FY19E

FY18E

FY19E

Agri / Agri Chemical

Rallis

Reduce

231

209

4,501

1,873

2,099

15.0

15.0

9.5

10.5

24.4

22.0

3.7

3.4

15.8

16.0

2.3

2.1

United Phosphorus

Accumulate

754

820

38,340

18,922

21,949

18.0

18.5

36.2

45.6

20.8

16.5

4.4

3.6

22.7

23.8

2.2

1.8

Auto & Auto Ancillary

Ashok Leyland

Accumulate

115

127

33,589

23,339

27,240

10.1

10.8

4.7

6.2

24.7

18.5

4.9

4.4

20.0

23.6

1.4

1.2

Bajaj Auto

Neutral

3,293

-

95,287

23,936

27,955

19.5

20.1

142.7

167.3

23.1

19.7

5.0

4.5

21.8

22.8

3.6

3.0

Bharat Forge

Buy

710

875

33,068

7,637

8,755

21.7

23.2

36.1

47.3

19.7

15.0

3.5

3.0

18.5

20.8

4.2

3.6

Eicher Motors

Neutral

30,397

-

82,749

19,043

22,837

19.5

19.9

835.4

1,019.0

36.4

29.8

13.6

10.5

40.9

37.8

4.2

3.5

Gabriel India

Neutral

191

-

2,739

1,782

2,033

9.7

10.2

7.1

8.9

26.9

21.6

5.4

4.6

21.0

22.2

1.5

1.3

Hero Motocorp

Accumulate

3,681

4,129

73,502

32,239

36,878

16.0

15.6

184.4

206.5

20.0

17.8

6.3

5.5

31.3

30.7

2.1

1.8

Jamna Auto Industries Neutral

60

-

2,393

1,441

1,662

14.4

14.8

13.9

17.6

4.3

3.4

1.2

1.0

30.0

31.0

1.7

1.4

Mahindra and Mahindra Neutral

1,418

-

88,142

46,971

53,816

13.6

14.0

67.7

79.8

21.0

17.8

3.0

2.7

15.0

15.9

1.8

1.5

Maruti

Accumulate

8,424

8,890

254,457

80,985

97,917

15.6

16.9

282.3

370.4

29.8

22.7

6.5

5.3

21.8

23.1

2.8

2.2

Minda Industries

Neutral

1,136

-

9,815

4,328

5,084

11.0

11.9

27.3

36.4

41.7

31.2

8.8

6.9

23.1

25.6

2.3

2.0

Motherson Sumi

Neutral

352

-

74,197

55,937

64,445

10.8

11.4

16.9

21.1

20.9

16.7

4.7

4.8

25.2

25.4

1.4

1.2

Tata Motors

Neutral

424

-

122,496

303,167

343,649

11.8

13.8

33.1

54.7

12.8

7.8

2.1

1.7

16.9

23.0

0.5

0.4

TVS Motor

Neutral

708

-

33,650

13,992

16,216

9.0

9.4

17.1

20.3

41.5

34.9

11.0

8.5

29.7

27.7

2.3

2.0

Amara Raja Batteries

Accumulate

803

858

13,724

6,140

7,122

14.3

15.6

29.3

39.0

27.4

20.6

4.7

3.9

17.1

19.0

2.2

1.9

Exide Industries

Neutral

203

-

17,264

8,689

9,854

15.1

15.2

9.7

11.0

21.1

18.5

3.7

3.3

15.7

16.1

1.7

1.5

Apollo Tyres

Neutral

246

-

14,044

15,739

17,326

13.3

14.6

20.4

26.7

12.0

9.2

1.5

1.3

20.4

26.7

1.1

1.0

Ceat

Neutral

1,840

-

7,441

6,661

7,717

11.1

14.2

116.2

178.2

15.8

10.3

2.8

2.3

15.2

21.3

1.2

1.1

JK Tyres

Neutral

146

-

3,322

8,318

9,239

16.2

16.4

21.0

27.5

7.0

5.3

1.4

1.1

19.1

20.4

0.8

0.7

Swaraj Engines

Neutral

1,887

-

2,344

788

889

16.4

16.5

71.6

81.0

26.4

23.3

7.6

7.1

29.6

31.0

2.6

2.3

Subros

Neutral

251

-

1,507

1,855

2,135

11.6

11.8

10.3

14.7

24.5

17.1

3.7

3.2

15.8

19.1

1.0

0.9

Capital Goods

BEML

Neutral

1,635

-

6,808

4,286

5,194

7.1

8.2

42.9

58.1

38.1

28.1

3.1

2.8

7.6

8.7

1.6

1.3

Bharat Electronics

Neutral

177

-

43,599

10,258

12,470

19.6

19.5

7.3

8.6

24.3

20.6

0.5

0.4

20.4

21.9

3.7

3.0

Voltas

Neutral

627

-

20,758

6,778

8,004

9.6

11.0

17.1

22.4

36.7

28.0

8.8

7.7

17.7

19.8

2.8

2.3

BHEL

Neutral

88

-

32,125

33,200

39,167

6.8

9.5

6.2

11.2

14.1

7.8

0.7

0.6

4.6

8.0

0.5

0.4

Blue Star

Buy

697

867

6,681

5,220

6,207

6.3

6.6

16.8

22.3

41.5

31.3

8.2

7.3

19.9

23.3

1.2

1.0

CG Power and Industrial

Neutral

86

-

5,412

6,555

7,292

7.5

7.5

-

0.8

8,635.0

107.9

1.3

1.4

0.1

1.2

0.9

0.8

Solutions

Greaves Cotton

Neutral

121

-

2,960

1,778

1,993

14.7

15.1

8.1

9.1

15.0

13.3

3.4

3.1

21.8

23.6

1.4

1.3

Stock Watch

November 22, 2017

Company Name

Reco

CMP

Target

Mkt Cap

Sales ( Čcr )

OPM(%)

EPS (Č)

PER(x)

P/BV(x)

RoE(%)

EV/Sales(x)

(Č)

Price ( Č)

( Č cr )

FY18E FY19E

FY18E

FY19E

FY18E

FY19E

FY18E

FY19E

FY18E

FY19E

FY18E

FY19E

FY18E

FY19E

Capital Goods

KEC International

Buy

301

350

7,744

9,779

11,113

9.4

9.8

14.2

18.2

21.2

16.6

4.1

3.3

21.1

22.1

1.1

0.9

KEI Industries

Accumulate

333

380

2,608

3,001

3,391

10.0

10.0

13.0

16.1

25.6

20.7

4.7

3.9

18.2

18.7

1.0

0.9

Thermax

Neutral

1,052

-

12,536

4,125

4,747

10.3

10.8

26.7

31.5

39.4

33.4

4.4

4.0

11.2

12.0

2.8

2.4

VATech Wabag

Buy

548

681

2,994

3,867

4,126

9.6

10.0

34.9

39.8

15.7

13.8

2.6

2.2

17.7

17.5

0.8

0.7

Cement

ACC

Neutral

1,705

-

32,013

12,255

13,350

13.5

14.3

58.0

66.2

29.4

25.8

3.5

3.3

11.5

12.2

2.6

2.4

Ambuja Cements

Neutral

262

-

51,974

10,250

11,450

17.5

19.0

7.2

8.3

36.4

31.5

2.6

2.5

7.0

7.8

4.9

4.3

India Cements

Neutral

170

-

5,251

6,135

6,750

14.8

15.2

8.5

11.5

20.1

14.8

1.0

0.9

4.8

6.2

1.2

1.0

JK Cement

Neutral

994

-

6,946

4,150

4,775

19.2

20.0

49.0

63.5

20.3

15.7

3.2

2.8

17.0

18.5

2.1

1.8

J K Lakshmi Cement

Neutral

399

-

4,692

3,422

3,757

15.5

17.0

13.5

23.2

29.5

17.2

3.1

2.6

10.8

15.5

1.8

1.5

Orient Cement

Neutral

166

-

3,406

2,215

3,233

16.8

17.0

5.9

6.9

28.2

24.1

2.2

2.0

10.8

10.1

2.5

1.7

UltraTech Cement

Neutral

4,162

-

114,256

28,250

35,150

20.2

23.5

77.5

122.2

53.7

34.1

4.5

4.1

9.6

14.8

4.5

3.6

Construction

KNR Constructions

Neutral

275

-

3,865

1,846

2,203

14.5

14.5

12.1

13.7

22.7

20.1

1.2

1.1

17.5

16.7

2.1

1.8

Larsen & Toubro

Neutral

1,222

-

171,164

95,787

109,476

10.2

11.6

44.5

50.8

27.5

24.1

3.4

3.2

12.9

13.1

2.3

2.1

Gujarat Pipavav Port

Neutral

140

-

6,768

739

842

61.6

62.7

5.1

6.2

27.5

22.8

3.4

3.3

12.7

14.9

8.6

7.4

PNC Infratech

Neutral

184

-

4,707

2,040

2,935

13.0

13.0

6.4

9.0

28.7

20.4

0.7

0.7

9.7

12.2

2.3

1.7

Simplex Infra

Neutral

559

-

2,765

6,012

6,619

11.6

11.7

21.1

31.0

26.6

18.1

1.8

1.7

6.5

8.6

1.0

0.9

Sadbhav Engineering

Neutral

339

-

5,820

3,823

4,426

10.7

10.8

10.3

11.8

32.9

28.8

3.9

3.5

10.1

10.5

1.8

1.6

NBCC

Neutral

271

-

24,381

9,099

12,706

6.4

6.4

7.3

9.6

37.2

28.3

1.6

1.3

27.5

30.5

2.5

1.8

MEP Infra

Neutral

101

-

1,640

2,403

2,910

18.3

16.8

2.4

6.1

42.9

16.6

16.3

11.0

35.2

55.8

1.8

1.5

SIPL

Neutral

138

-

4,859

2,060

2,390

46.8

47.7

(5.8)

(3.1)

5.2

5.9

(14.2)

(2.3)

7.1

6.6

Engineers India

Neutral

184

-

12,403

1,795

2,611

21.1

22.4

5.9

8.1

31.2

22.7

2.2

2.2

12.9

16.1

5.3

3.5

Financials

Axis Bank

Accumulate

547

580

131,114

32,558

35,843

3.5

3.2

27.8

41.0

19.7

13.3

2.1

1.9

11.4

14.9

-

-

Bank of Baroda

Neutral

181

-

41,590

22,533

26,079

2.4

2.4

12.0

20.9

15.0

8.6

1.0

0.9

6.6

11.0

-

-

Canara Bank

Neutral

392

-

23,435

17,925

20,235

2.0

2.1

18.5

36.5

21.2

10.8

0.8

0.8

3.4

6.2

-

-

Can Fin Homes

Neutral

462

-

6,155

586

741

3.5

3.5

107.8

141.0

4.3

3.3

0.9

0.8

24.1

25.6

-

-

Cholamandalam Inv. &

Neutral

1,294

-

20,226

2,826

3,307

6.3

6.3

53.7

64.6

24.1

20.1

4.1

3.5

18.3

18.9

-

-

Fin. Co.

Dewan Housing Finance Accumulate

621

712

19,486

2,676

3,383

2.4

2.7

37.4

49.7

16.6

12.5

2.2

1.9

13.8

16.2

-

-

Equitas Holdings

Buy

145

235

4,934

1,125

1,380

9.6

9.8

1.5

6.0

96.9

24.2

2.2

2.1

2.4

8.2

-

-

Federal Bank

Accumulate

112

125

21,986

4,896

5,930

2.8

3.1

5.4

7.6

20.9

14.8

1.8

1.6

8.5

11.0

-

-

Stock Watch

November 22, 2017

Company Name

Reco

CMP

Target

Mkt Cap

Sales ( Čcr )

OPM(%)

EPS (Č)

PER(x)

P/BV(x)

RoE(%)

EV/Sales(x)

(Č)

Price ( Č)

( Č cr )

FY18E FY19E

FY18E

FY19E

FY18E

FY19E

FY18E

FY19E

FY18E

FY19E

FY18E

FY19E

FY18E

FY19E

Financials

GIC Housing

Buy

431

655

2,323

376

477

3.6

3.7

33.0

40.0

13.1

10.8

2.3

2.0

20.0

23.0

-

-

HDFC Bank

Neutral

1,846

-

477,398

55,236

63,253

4.5

4.4

68.9

82.4

26.8

22.4

4.7

3.9

18.7

18.5

-

-

ICICI Bank

Neutral

320

-

205,444

42,361

51,378

3.6

3.9

18.4

25.7

17.4

12.4

1.9

1.8

11.3

15.0

-

-

Karur Vysya Bank

Buy

122

180

7,348

3,289

3,630

3.7

3.9

10.8

14.1

11.2

8.6

1.3

1.2

12.5

14.7

-

-

LIC Housing Finance

Neutral

601

-

30,328

4,895

6,332

3.4

3.7

50.7

66.8

11.9

9.0

2.4

2.0

21.7

23.8

-

-

Punjab Natl.Bank

Neutral

186

-

39,612

23,708

25,758

2.1

2.1

5.9

16.4

31.7

11.3

0.9

0.9

3.0

8.3

-

-

RBL Bank

Neutral

512

-

21,317

2,309

2,888

2.6

2.5

16.4

19.1

31.3

26.9

3.9

3.5

13.3

13.8

-

-

Repco Home Finance

Buy

618

825

3,867

496

597

4.4

4.2

38.5

48.7

16.1

12.7

2.9

2.4

19.6

20.6

-

-

South Ind.Bank

Neutral

31

-

5,670

3,195

3,567

3.0

3.1

3.0

3.8

10.4

8.2

1.0

0.9

10.5

11.9

-

-

St Bk of India

Neutral

331

-

285,505

105,827

121,056

2.4

2.5

16.1

25.6

20.6

12.9

1.6

1.5

6.6

9.9

-

-

Union Bank

Neutral

168

-

12,215

14,650

16,225

2.3

2.3

23.1

32.5

7.3

5.2

0.6

0.5

7.1

9.2

-

-

Yes Bank

Neutral

312

-

71,576

11,088

13,138

3.0

2.9

84.0

99.3

3.7

3.1

0.6

0.5

16.3

16.8

-

-

FMCG

Akzo Nobel India

Neutral

1,790

-

8,585

3,164

3,607

13.8

13.7

58.6

67.9

30.6

26.4

7.5

6.6

24.5

25.1

2.6

2.2

Asian Paints

Neutral

1,161

-

111,396

17,603

20,615

18.6

18.6

2,128.9

2,543.3

0.6

0.5

11.5

9.7

28.0

28.9

6.1

5.2

Britannia

Neutral

4,821

-

57,877

9,690

11,278

14.8

15.4

84.0

101.0

57.4

47.7

20.9

16.6

40.6

39.0

5.9

5.1

Colgate

Neutral

1,044

-

28,389

4,420

5,074

24.9

25.3

28.6

32.8

36.5

31.8

14.4

11.6

43.8

40.5

6.2

5.3

Dabur India

Neutral

339

-

59,786

8,346

9,344

19.6

19.9

7.8

9.0

43.5

37.7

8.8

7.9

25.2

24.8

6.8

6.0

GlaxoSmith Con*

Neutral

6,022

-

25,328

5,072

5,760

18.2

18.4

176.3

199.2

34.2

30.2

7.2

6.6

21.2

21.7

4.3

3.7

Godrej Consumer

Neutral

953

-

64,900

10,171

11,682

20.8

21.5

21.7

27.1

43.9

35.2

9.9

8.5

22.3

23.4

6.5

5.6

HUL

Neutral

1,277

-

276,447

37,077

41,508

20.3

21.8

5,189.9

6,318.5

0.3

0.2

38.9

33.3

74.8

82.0

7.3

6.5

ITC

Neutral

256

-

312,315

44,588

49,853

37.0

37.3

9.6

11.0

26.7

23.3

6.6

6.2

25.1

27.3

6.5

5.8

Marico

Neutral

304

-

39,298

6,788

7,766

18.5

19.2

7.1

8.5

42.9

35.8

15.0

12.9

36.9

38.0

5.6

4.9

Nestle*

Neutral

7,750

-

74,719

10,083

11,182

20.0

20.9

119.7

141.3

64.7

54.9

228.2

208.6

36.7

39.8

7.1

6.3

Tata Global

Neutral

273

-

17,239

7,121

7,641

11.9

12.3

6.9

8.0

39.6

34.1

2.6

2.5

6.8

7.2

2.2

2.1

Procter & Gamble

Neutral

9,150

-

29,702

3,034

3,579

27.1

27.7

167.7

198.8

54.6

46.0

14.6

12.6

28.8

29.5

9.2

7.7

Hygiene

IT

HCL Tech^

Buy

837

1,014

119,496

50,009

54,608

22.1

22.1

62.8

67.6

13.3

12.4

3.0

2.6

22.4

20.6

2.0

1.8

Infosys

Buy

966

1,120

221,981

70,333

75,960

26.0

26.0

61.7

65.9

15.7

14.7

3.0

2.8

18.9

18.7

2.5

2.3

TCS

Reduce

2,677

2,442

512,388

123,384

134,488

26.1

26.1

133.2

143.7

20.1

18.6

5.5

5.2

27.6

27.8

3.8

3.4

Tech Mahindra

Accumulate

494

526

48,229

30,545

32,988

15.0

15.0

35.2

37.6

14.0

13.1

2.4

2.2

16.8

16.2

1.4

1.2

Stock Watch

November 22, 2017

Company Name

Reco

CMP

Target

Mkt Cap

Sales ( Čcr )

OPM(%)

EPS (Č)

PER(x)

P/BV(x)

RoE(%)

EV/Sales(x)

(Č)

Price ( Č)

( Č cr )

FY18E FY19E

FY18E

FY19E

FY18E

FY19E

FY18E

FY19E

FY18E

FY19E

FY18E

FY19E

FY18E

FY19E

IT

Wipro

Neutral

294

-

143,056

54,164

56,544

22.3

22.3

18.8

19.5

15.6

15.1

2.5

2.2

15.0

13.6

1.9

1.6

Media

D B Corp

Neutral

361

-

6,649

2,404

2,625

30.5

31.5

23.7

26.9

15.3

13.4

3.6

3.1

23.5

22.8

2.6

2.4

HT Media

Neutral

100

-

2,322

2,589

2,830

15.1

15.4

8.3

10.9

12.0

9.2

1.0

0.9

8.4

10.4

0.4

0.3

Jagran Prakashan

Buy

163

225

5,085

2,541

2,835

28.5

28.7

12.7

14.1

12.9

11.6

2.7

2.3

21.3

21.4

1.9

1.6

Sun TV Network

Neutral

848

-

33,430

3,238

3,789

51.9

55.1

30.9

38.0

27.5

22.3

7.8

6.9

30.0

31.0

9.8

8.3

Hindustan Media

Neutral

243

-

1,784

1,002

1,074

23.3

23.5

29.2

33.8

8.3

7.2

1.3

1.1

15.6

15.4

0.8

0.5

Ventures

TV Today Network

Buy

377

435

2,247

667

727

27.7

27.7

18.6

20.1

20.3

18.8

3.2

3.2

15.6

17.3

2.9

2.7

Music Broadcast Limited Buy

371

434

2,116

271

317

91.0

109.0

6.0

10.0

61.8

37.1

3.9

3.5

6.5

9.3

7.4

6.1

Metals & Mining

Coal India

Neutral

274

-

170,114

82,301

91,235

17.0

18.0

17.1

20.5

16.0

13.4

3.0

2.8

45.0

55.0

1.7

1.6

Hind. Zinc

Neutral

316

-

133,562

22,108

24,555

57.0

58.0

22.1

26.3

14.3

12.0

4.6

3.8

32.0

35.0

5.0

4.2

Hindalco

Neutral

261

-

58,690

102,350

105,355

13.5

14.5

21.5

24.5

12.2

10.7

1.7

1.4

15.0

15.2

1.1

1.1

JSW Steel

Neutral

268

-

64,830

64,500

68,245

21.1

21.5

20.1

21.2

13.3

12.7

2.4

2.1

-

-

1.7

1.7

NMDC

Neutral

126

-

39,960

10,209

11,450

47.0

48.0

11.1

12.1

11.4

10.4

1.6

1.5

-

-

3.4

3.1

SAIL

Neutral

83

-

34,280

54,100

63,555

3.0

10.0

(10.0)

1.5

55.3

1.1

1.1

-

-

1.6

1.4

Vedanta

Neutral

313

-

116,311

81,206

87,345

28.0

29.0

26.5

33.5

11.8

9.3

2.7

2.3

-

-

2.2

1.9

Tata Steel

Neutral

711

-

69,078

121,445

126,500

16.2

17.2

65.4

81.3

10.9

8.8

1.7

1.5

-

-

1.1

1.0

Oil & Gas

GAIL

Neutral

459

-

77,572

53,115

52,344

14.2

15.3

30.0

31.1

15.3

14.8

1.9

1.8

-

-

1.2

1.2

ONGC

Neutral

181

-

232,089

83,111

84,934

44.2

44.9

16.4

16.9

11.0

10.7

1.3

1.2

-

-

2.7

2.6

Indian Oil Corp

Neutral

396

-

192,294

396,116

432,560

8.5

8.8

40.1

42.2

9.9

9.4

1.7

1.5

-

-

0.6

0.6

Reliance Industries

Neutral

932

-

606,415

257,711

267,438

17.0

18.2

89.1

89.5

10.5

10.4

1.0

0.9

-

-

2.0

1.9

Pharmaceuticals

Alembic Pharma

Buy

515

600

9,703

3,346

3,915

19.6

19.2

21.0

23.9

24.5

21.5

4.3

3.7

19.1

18.4

2.9

2.5

Alkem Laboratories Ltd

Accumulate

1,954

2,125

23,368

6,320

7,341

17.5

19.8

72.7

96.6

26.9

20.2

4.8

4.0

16.7

18.7

3.6

3.1

Aurobindo Pharma

Buy

709

823

41,563

17,086

19,478

22.1

22.0

44.7

51.4

15.9

13.8

3.5

2.8

24.7

22.7

2.5

2.2

Aventis*

Neutral

4,477

-

10,311

2,411

2,698

18.8

18.8

151.6

163.9

29.5

27.3

4.6

3.7

25.4

27.5

3.9

3.2

Cadila Healthcare

Neutral

448

-

45,869

11,584

13,228

20.3

20.4

18.7

21.3

24.0

21.0

5.3

4.4

24.6

22.9

3.8

3.3

Cipla

Sell

617

462

49,609

16,163

18,711

16.6

16.9

20.7

24.3

29.8

25.4

3.5

3.1

12.6

13.1

3.2

2.7

Dr Reddy's

Neutral

2,391

-

39,646

15,844

17,973

17.6

18.2

91.7

111.0

26.1

21.5

3.0

2.7

11.9

13.0

2.7

2.4

GSK Pharma*

Neutral

2,491

-

21,096

2,968

3,324

13.8

15.9

37.8

46.3

65.9

53.8

11.5

12.6

16.7

22.4

6.9

6.3

Indoco Remedies

Sell

270

153

2,488

1,154

1,310

14.9

14.9

11.3

12.7

23.9

21.3

3.4

3.0

15.0

15.0

2.3

2.0

Stock Watch

November 22, 2017

Company Name

Reco

CMP

Target

Mkt Cap

Sales ( Čcr )

OPM(%)

EPS (Č)

PER(x)

P/BV(x)

RoE(%)

EV/Sales(x)

(Č)

Price ( Č)

( Č cr )

FY18E FY19E

FY18E

FY19E

FY18E

FY19E

FY18E

FY19E

FY18E

FY19E

FY18E

FY19E

FY18E

FY19E

Pharmaceuticals

Ipca labs

Neutral

542

-

6,835

3,593

4,022

14.5

15.5

19.4

25.2

27.9

21.5

2.6

2.3

9.5

11.2

2.0

1.8

Lupin

Buy

838

1,091

37,854

16,240

18,562

21.3

21.7

42.5

49.6

19.7

16.9

2.5

2.2

13.3

13.7

2.4

2.1

Natco Pharma

Buy

906

1,057

15,804

1,886

2,016

32.3

29.5

23.2

22.0

39.1

41.1

8.2

7.2

20.9

17.6

8.2

7.7

Sun Pharma

Neutral

538

-

129,092

32,899

36,451

26.9

25.4

31.6

32.3

17.0

16.7

3.0

2.6

18.7

18.8

3.5

3.0

Syngene International

Accumulate

516

556

10,326

1,394

1,818

33.0

36.0

15.8

20.6

32.6

25.1

6.1

5.0

18.6

20.0

7.4

5.7

Power

Tata Power

Neutral

93

-

25,127

32,547

33,806

20.5

20.5

4.7

5.4

19.8

17.4

1.9

1.6

10.5

10.5

1.8

1.7

NTPC

Neutral

183

-

150,933

86,070

101,246

28.3

30.7

12.9

16.2

14.2

11.3

1.5

1.4

10.6

12.4

3.1

2.8

Power Grid

Accumulate

207

223

108,189

29,183

32,946

89.7

90.0

18.0

20.8

11.5

9.9

1.9

1.7

17.7

18.2

7.6

7.1

Real Estate

Prestige Estate

Neutral

308

-

11,531

4,607

5,146

21.0

22.2

7.9

9.8

38.9

31.4

2.4

2.2

10.3

12.0

3.7

3.3

MLIFE

Buy

447

522

2,296

487

590

12.3

17.8

21.0

31.2

21.3

14.3

1.1

1.1

5.2

7.4

3.4

2.8

Telecom

Bharti Airtel

Neutral

503

-

201,129

97,903

105,233

36.0

36.3

9.3

11.1

54.1

45.5

2.6

2.5

5.0

5.6

3.0

2.7

Idea Cellular

Neutral

101

-

36,361

35,012

37,689

27.1

27.7

(4.4)

(2.7)

1.6

1.6

(6.8)

(4.6)

2.3

2.1

zOthers

Abbott India

Neutral

4,996

-

10,616

3,244

3,723

14.9

16.1

167.5

209.4

29.8

23.9

6.6

5.5

23.7

24.8

2.9

2.5

Asian Granito

Buy

494

570

1,486

1,169

1,286

12.5

12.5

16.0

19.7

30.9

25.1

3.3

2.9

10.7

11.6

1.5

1.3

Bajaj Electricals

Neutral

408

-

4,152

4,646

5,301

6.7

7.6

16.1

22.3

25.4

18.3

4.1

3.5

16.4

19.2

0.9

0.8

Banco Products (India)

Neutral

222

-

1,588

1,530

1,695

13.2

12.7

19.0

20.0

11.7

11.1

1.9

1.7

0.2

0.2

1.0

105.4

Coffee Day Enterprises

Neutral

231

-

4,759

3,494

3,913

17.4

18.0

4.8

5.7

-

40.5

2.1

2.0

-

0.1

1.8

1.6

Ltd

Elecon Engineering

Neutral

78

-

870

171

201

15.0

16.2

36.0

43.0

2.2

1.8

0.2

0.2

0.1

0.1

4.5

3.8

Garware Wall Ropes

Neutral

923

-

2,020

928

1,003

15.2

15.2

39.4

43.2

23.4

21.4

3.9

3.3

16.5

15.4

2.0

1.8

Goodyear India*

Neutral

822

-

1,895

1,717

1,866

11.8

12.3

47.9

49.8

17.1

16.5

2.7

2.3

15.6

15.7

0.8

114.4

Hitachi

Neutral

2,500

-

6,798

2,355

2,715

10.3

10.8

49.0

60.9

51.0

41.1

11.9

9.4

0.2

0.2

2.9

2.5

HSIL

Neutral

485

-

3,507

2,240

2,670

14.6

15.0

17.0

22.0

28.5

22.1

2.3

2.2

0.1

0.1

1.8

1.5

Interglobe Aviation

Neutral

1,166

-

44,792

22,570

27,955

14.2

15.0

63.6

81.8

18.4

14.3

9.7

8.2

0.5

0.6

1.7

1.3

Jyothy Laboratories

Neutral

346

-

6,296

1,781

2,044

14.1

15.0

9.4

10.5

37.0

33.0

7.9

7.4

0.2

0.2

3.8

3.2

Linc Pen & Plastics

Neutral

274

-

405

420

462

9.3

9.3

15.3

17.1

17.9

16.0

3.0

3.1

16.9

19.5

1.0

0.9

M M Forgings

Neutral

873

-

1,054

542

642

20.1

21.0

41.6

56.8

21.0

15.4

2.9

2.5

0.1

0.2

2.4

2.1

Mirza International

Neutral

166

-

1,992

1,148

1,285

18.0

18.0

8.0

9.4

20.6

17.7

3.4

2.9

16.3

16.1

1.9

1.7

Navkar Corporation

Buy

190

265

2,866

561

617

41.5

41.5

11.5

12.7

16.5

15.0

1.7

1.6

10.5

10.4

5.8

5.0

Nilkamal

Neutral

1,620

-

2,417

2,317

2,525

11.4

11.1

96.0

105.0

16.9

15.4

2.9

2.5

0.2

0.2

1.0

0.9

Stock Watch

November 22, 2017

Company Name

Reco

CMP

Target Mkt Cap

Sales ( Čcr )

OPM(%)

EPS (Č)

PER(x)

P/BV(x)

RoE(%)

EV/Sales(x)

(Č)

Price ( Č)

( Č cr )

FY18E FY19E FY18E FY19E FY18E FY19E FY18E FY19E FY18E FY19E FY18E FY19E FY18E FY19E

zOthers

Parag Milk Foods

Neutral

236

-

1,988

1,987

2,379

7.6

9.0

12.4

18.3

19.1

12.9

2.7

2.4

8.2

13.2

1.1

1.0

Radico Khaitan

Neutral

281

-

3,736

1,811

1,992

13.2

13.2

8.1

8.8

34.6

31.9

3.5

3.8

10.1

12.0

2.4

2.2

Relaxo Footwears

Neutral

571

-

6,873

1,981

2,310

13.7

14.5

12.0

15.5

47.6

36.9

9.3

7.5

0.2

0.2

3.5

3.0

Siyaram Silk Mills

Accumulate

585

650

2,741

1,769

1,981

12.7

12.7

22.6

26.2

25.9

22.3

4.0

3.5

15.5

15.5

1.7

1.5

Styrolution ABS India* Neutral

930

-

1,635

1,800

1,980

8.0

8.1

42.0

46.2

22.1

20.1

2.5

2.2

0.1

0.1

1.0

0.9

Surya Roshni

Neutral

370

-

1,624

4,870

5,320

7.7

7.8

22.8

28.1

16.3

13.2

2.2

1.9

0.1

0.1

0.6

0.5

TVS Srichakra

Neutral

3,349

-

2,564

2,729

2,893

12.7

12.5

248.5

265.0

13.5

12.6

3.8

3.1

0.3

0.3

0.9

0.9

Visaka Industries

Neutral

639

-

1,016

1,104

1,214

12.1

12.6

31.0

37.9

20.6

16.9

2.5

2.3

0.1

0.1

1.1

1.0

VIP Industries

Neutral

310

-

4,377

1,450

1,693

10.4

10.5

6.5

7.8

47.3

39.7

10.0

8.8

21.1

22.1

3.0

2.6

Navin Fluorine

Neutral

697

-

3,435

945

1,154

22.4

22.6

28.7

34.8

24.3

20.0

4.0

3.4

-

-

3.2

2.5

Source: Company, Angel Research; Note: *December year end; #September year end; &October year end; Price as on November 21, 2017

Market Outlook

November 22, 2017

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India

Limited,Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with

CDSL and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or

co-managed public offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make

such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies

referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and

risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.